INVEST IN A SURE THING. YOURSELF.

MAKING SAVING EASY MAKES MORE POSSIBLE.

START SMALL. GROW PEACE OF MIND.

Starting your savings can be as small as rounded up change that we match 100 percent for the first three months. Growing savings can be as simple as a new account with features that fuel your balance. We have accounts for beginners that build interest on low minimum balances, ways to save for a dream vacation, your family’s Christmas wish list or even medical emergencies. Start saving today, and you’ll start seeing a bright future as yours to bank on.

Savings Calculator

Estimate Only

Interactive calculators are available as self-help tools for your independent use to provide estimates for illustrative purposes.

Savings Account Comparison

YourStart® Savings APPLY NOW | Great Start Savings APPLY NOW | Christmas Club Savings APPLY NOW | Vacation Club Savings APPLY NOW | Kids Start Savings LEARN MORE | Money Market Plus LEARN MORE |

|

|---|---|---|---|---|---|---|

|

Minimum Open / Minimum Balance

|

YourStart® Savings APPLY NOW: $50 |

Great Start Savings APPLY NOW: $100 |

Christmas Club Savings APPLY NOW: $5 |

Vacation Club Savings APPLY NOW: $5 |

Kids Start Savings LEARN MORE: $0 |

Money Market Plus LEARN MORE: $2,500 |

|

Service Charge for Falling Below Minimum

|

YourStart® Savings APPLY NOW: $3 |

Great Start Savings APPLY NOW: $3 |

Christmas Club Savings APPLY NOW: $0 |

Vacation Club Savings APPLY NOW: $0 |

Kids Start Savings LEARN MORE: $0 |

Money Market Plus LEARN MORE: $10 |

|

Withdrawals Allowed

|

YourStart® Savings APPLY NOW: 4 |

Great Start Savings APPLY NOW: 4 |

Christmas Club Savings APPLY NOW: n/a |

Vacation Club Savings APPLY NOW: n/a |

Kids Start Savings LEARN MORE: 4 |

Money Market Plus LEARN MORE: 6 |

|

Fee Per Excess Withdrawal

|

YourStart® Savings APPLY NOW: $2 |

Great Start Savings APPLY NOW: $2 |

Christmas Club Savings APPLY NOW: n/a |

Vacation Club Savings APPLY NOW: n/a |

Kids Start Savings LEARN MORE: $2 |

Money Market Plus LEARN MORE: $10 |

|

Online & Mobile Banking, E-Statements

|

YourStart® Savings APPLY NOW: |

Great Start Savings APPLY NOW: |

Christmas Club Savings APPLY NOW: |

Vacation Club Savings APPLY NOW: |

Kids Start Savings LEARN MORE: |

Money Market Plus LEARN MORE: |

|

VISA Debit Card

|

Money Market Plus LEARN MORE: | |||||

|

Free Paper Statements

|

YourStart® Savings APPLY NOW: Combined with Checking |

Great Start Savings APPLY NOW: |

Christmas Club Savings APPLY NOW: |

Vacation Club Savings APPLY NOW: |

Kids Start Savings LEARN MORE: |

Money Market Plus LEARN MORE: |

|

Your Swipe Capability

|

YourStart® Savings APPLY NOW: |

Great Start Savings APPLY NOW: | ||||

|

Type of Interest

|

YourStart® Savings APPLY NOW: Tiered |

Great Start Savings APPLY NOW: Flat |

Christmas Club Savings APPLY NOW: Flat |

Vacation Club Savings APPLY NOW: Flat |

Kids Start Savings LEARN MORE: Flat |

Money Market Plus LEARN MORE: Tiered |

|

Rate Perks

|

YourStart® Savings APPLY NOW: Premium Rate on First $15,000 |

Christmas Club Savings APPLY NOW: Locked for Club Cycle |

Vacation Club Savings APPLY NOW: Locked for Club Cycle |

Kids Start Savings LEARN MORE: Premium Rate until age 18 | ||

|

Owner Restrictions

|

YourStart® Savings APPLY NOW: YourStart Checking |

Vacation Club Savings APPLY NOW:FNB Bank Deposit Account |

Kids Start Savings LEARN MORE: Under age 18 | |||

|

|

YourStart® Savings APPLY NOW: More Information… |

Great Start Savings APPLY NOW: More Information… |

Christmas Club Savings APPLY NOW: More Information… |

Vacation Club Savings APPLY NOW: More Information… |

Kids Start Savings LEARN MORE: More Information… |

Money Market Plus LEARN MORE: More Information… |

BUNDLING ACCOUNTS WILL WARM YOU UP TO SAVING.

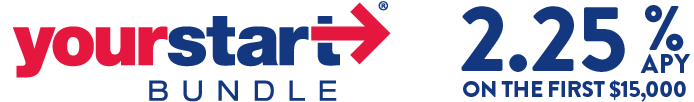

YOURSTART® CHECKING + SAVINGS BUNDLE

With our YourStart® Checking and Savings combo, you have more freedom and less fees with complimentary nationwide ATM withdrawals and mobile banking with mobile deposit.1 Plus, enjoy unlimited check writing and a welcome box of checks (with 30% off future check orders)! You can avoid a monthly $10 service fee if each month you have 12 debit card transactions and one direct deposit or automatic payment (ACH) post and clear during the statement cycle.

The YourStart® bundle features a savings account that earns premium interest rates on the first $15,000, currently 2.25% APY.2 As long as your savings balance is at least $50, you can avoid a $3 monthly fee. You’ll also enjoy four free of charge withdrawals per month ($2 per excess withdrawal).

JUMP START YOUR SAVINGS BY ROUNDING UP WITH FNB’S YOUR SWIPE FEATURE.

Grow your savings faster by enrolling in our Your Swipe savings feature. Every time you swipe your FNB debit card, we’ll round up the purchase to the nearest dollar and transfer the difference right into your YourStart® savings account. We’ll even match your rounded savings dollar for dollar for the first three months after account opening and 10 percent after the introductory three-month period.3

The Your Swipe round up feature is also available when you pair a Great Start Savings with Great Start, Your Club or Best Start Student Checking. Our Your Swipe Savings has helped our currently enrolled customers save over $2,300,000 and $502,150 just in 2022! Learn more about how Your Swipe will get your savings on a roll.

NOT JUST ANOTHER ACCOUNT NUMBER. CHECKING FEATURES THAT COUNT.

A smart and easy way to save for Christmas or property taxes, sign up for Christmas Club Savings today with a minimum deposit of just $5 and no monthly service fee. Earn a competitive interest rate when you simply auto deduct savings in any amount up to $100 ($5 minimum) from your FNB checking account weekly, biweekly, semi-monthly or monthly and receive your payout in the form of an automatic deposit into your FNB account. You can also choose to make in branch deposits and receive your payout in the form of a check and earn a standard interest rate.

Christmas Club runs annually from October to October.

A smart and easy way to save for vacation or home improvements, sign up for Vacation Club today with a minimum deposit of just $5 and no monthly service fee. You simply auto deduct savings in any amount up to $100 ($5 minimum) from your FNB checking account weekly, biweekly, semi-monthly or monthly.

Vacation Club runs annually from March to March and pays a competitive interest rate. You’ll receive your payout in the form of an auto deposit into your FNB checking account.

Important Information

1For ATM fees of $5 or greater, ATM receipt(s) must be presented for reimbursement. ATM fees will be reimbursed at the end of each statement cycle. Mobile banking is required for mobile deposit. The mobile app is free, however, message and data rates may apply.

2YourStart® Checking and Savings accounts each require a minimum opening deposit of $50.00. YourStart® Savings is only available with a YourStart® Checking account and only one YourStart® Bundle allowed per primary account holder. Annual Percentage Yield (APY). For balances over $15,000.00 a standard rate of .25% APY will apply. APY information is accurate as of February 3, 2026, is subject to change and may change after account opening. Interest rate applies to YourStart® Savings only. Fees could reduce earnings on account.

3Checking account must have FNB debit card. If the account is closed before the matching funds are paid, the matching funds are lost. There is a $250 maximum match per year. Dollar for dollar match for the first three months limited to one per primary account holder.

Overdraft fees may apply.

BUILD HEALTHY FINANCIAL HABITS FROM THE START WITH A KIDS START SAVINGS ACCOUNT

RAISING FINANCIALLY-SMART KIDS JUST GOT EASIER